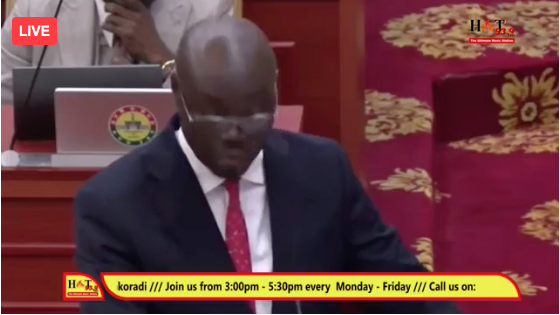

Finance Minister, Dr. Cassiel Ato Forson, has announced the removal of five nuisance taxes as part of government’s revenue measures under the 2025 Budget, presented to Parliament.

According to Dr. Forson, this move is in line with the government’s manifesto promise and efforts to reduce the financial burden on citizens and businesses.

Outlined in Parliament on Tuesday, March 11, 2025, the Minister stated that although government remains committed to increasing non-oil tax revenue by 0.6 percentage points of GDP under the IMF-supported programme, these taxes have been scrapped to improve disposable incomes, support business growth, and enhance tax compliance.

The five nuisance taxes removed are:

- The 10% withholding tax on lottery winnings (Betting Tax).

- The 1% Electronic Transfer Levy (E-Levy).

- The Emission Levy on industries and vehicles.

- The VAT on motor vehicle insurance policies.

- The 1.5% withholding tax on unprocessed gold winnings by small-scale miners.

Dr. Forson emphasized that eliminating these taxes will help ease pressure on households and stimulate economic activity.