The Bank of Ghana, wrestling with runaway inflation, is expected to deliver another hefty interest rate hike at its meeting later this month, with the country’s currency and public finances still under pressure, a Reuters poll of economists showed.

Nigeria’s central bank, meanwhile, is due to hold its key rate steady at the conclusion of its meeting later on Tuesday. The Central Bank of Kenya is also expected to keep rates steady at its meeting later this month.

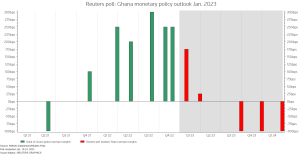

The median forecast from a survey of eight analysts taken Jan. 18-23 points to the Bank of Ghana raising rates 175 basis points to 28.75%, with only two expecting the bank to hold at 27.00% and the rest opting for a hike in a 100-400 basis point range.

“In Ghana, despite the central bank delivering 1,350 basis points of interest rate hikes, inflation has continued to rise,” said Virág Fórizs at Capital Economics.

Ghana’s consumer inflation surged to 54.1% in December, its highest level in 22 years, driven by fuel, utilities and food.

“With price pressures showing no sign of easing, we expect policymakers to raise the benchmark rate further,” said Fórizs.

Rates in Ghana are expected to rise another 25 basis points to 29.00% in March, then stay steady in May. The central bank is then forecast to cut them by 1 percentage point each in the third and last quarter of this year.

Pieter du Preez, a senior economist at Oxford Economics, said developments in the Ghanaian economy are unique at this stage and cannot be directly compared to other economies and central bank decisions elsewhere, where the trend is to slow the pace of tightening.

“The cedi appreciating in December will aid in driving inflation lower, but we only forecast this to happen from February or March onwards,” du Preez said.

Ghana’s cedi was the world’s worst-performing currency last year.

In Nigeria, Africa’s largest economy, the benchmark rate is due to hold steady at a much more modest 16.5% after four straight rate rises at its previous meetings.

Seven analysts in the poll expected that outcome, while three expected a 50 basis point hike and one said rates would rise by 100 basis points.

“In Nigeria, policymakers have been itching to end the tightening cycle and we think the fall in the headline inflation rate in December will give MPC members ammunition to do so,” said Capital Economics’ Fórizs.

Annual inflation in Nigeria dipped in December to 21.34% after 10 straight monthly increases.

But after February general elections in Nigeria, the policy rate is expected to rise in March by 25 basis points to 16.75% and again in May by 50 basis points to 17.25%, and by another 25 basis points to 17.50% in the third quarter.

In east Africa’s biggest economy, Kenya’s central bank is expected to also hold rates steady at 8.75% on Jan. 30, based on six out of nine analysts’ expectations. The remaining three expect a hike in a 25-75 basis point range. Rates were seen steady for the rest of the year.

In a separate poll, South Africa’s Reserve Bank is expected to raise its repo rate for the last time in this cycle in anticipation of slower inflation, adding 50 basis points on Jan. 26.